USAA Layoffs 2025: What’s Really Happening And How It Could Impact You

There’s been a lot of buzz lately about USAA layoffs in 2025, and it’s got everyone talking. If you're part of the USAA family—or even just someone who keeps an eye on corporate moves—you might be wondering what's going on. The financial world is changing fast, and big companies like USAA aren’t immune to the pressures of modern times. But don’t panic yet—let’s break this down step by step.

When rumors about layoffs start flying around, they can feel overwhelming. Whether you're an employee, a customer, or just curious about how these changes might ripple through the industry, understanding the situation is key. In this article, we’ll dive deep into the reasons behind the rumored USAA layoffs in 2025, what they mean for employees and customers, and how you can prepare for the future.

So grab your favorite drink, get comfy, and let’s explore what’s really happening with USAA in 2025. This isn’t just another news piece; it’s a detailed look at the bigger picture so you can make informed decisions moving forward. Let’s go!

Read also:Caitlin Clark Leaves Wnba A Deep Dive Into Her Decision And The Impact

Table of Contents

- The Background: Who Is USAA?

- Understanding Layoff Trends in 2025

- Why Are USAA Layoffs Happening?

- What’s the Impact on Employees and Customers?

- How Can You Prepare for These Changes?

- Is This Part of a Broader Industry Shift?

- Key Data and Stats About USAA

- What Should Customers Know?

- The Future of USAA

- Final Thoughts: Stay Calm and Informed

The Background: Who Is USAA?

About USAA

Let’s rewind for a sec. USAA has been around since 1922, originally founded to provide insurance for military members. Over the decades, it’s grown into a powerhouse offering banking, investments, insurance, and more. But here’s the kicker: USAA is member-owned, meaning its focus is on serving its members rather than shareholders. That’s a pretty big deal when you think about it.

USAA’s mission is clear—to help military members and their families achieve financial security. With over 13 million members, they’ve built a reputation as a trusted partner in the financial world. But like any big company, they face challenges—and that brings us to the rumored layoffs in 2025.

Understanding Layoff Trends in 2025

What’s Driving the Layoff Surge?

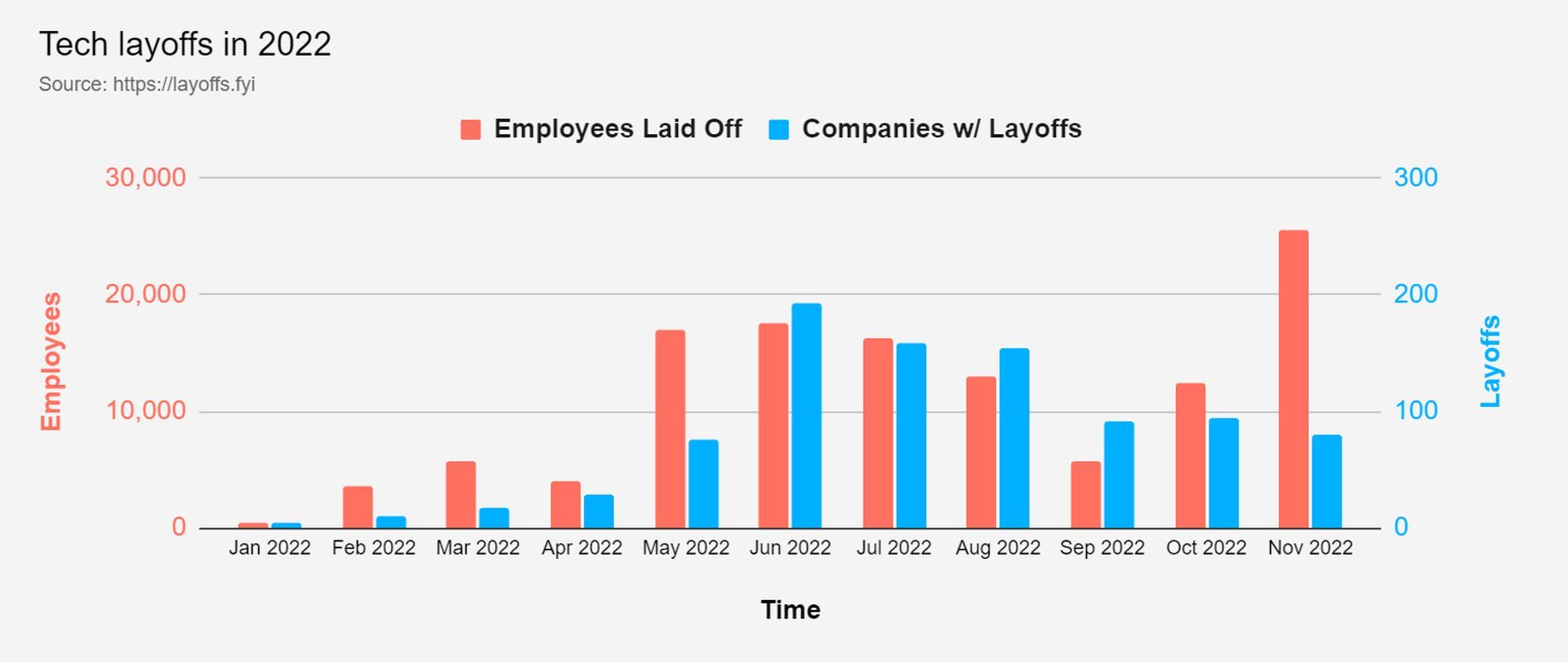

Before we zoom in on USAA, let’s talk about the broader trend. In 2025, layoffs aren’t exactly rare. Companies across industries are rethinking their workforce strategies due to factors like automation, shifting consumer behavior, and economic uncertainties. It’s not just about cutting costs—it’s about adapting to a rapidly changing landscape.

For USAA, the decision to lay off employees likely stems from similar pressures. They’re not alone in this, but that doesn’t make it any easier for those affected. The key question now is: How does USAA plan to navigate these changes while staying true to its mission?

Why Are USAA Layoffs Happening?

Automation and Technology

One of the biggest drivers behind USAA layoffs is the rise of automation. Think about it—AI and machine learning are revolutionizing the way financial services operate. Tasks that once required human intervention can now be handled by algorithms, saving time and money. While this is great for efficiency, it unfortunately means fewer roles for people.

Read also:Royal Challengers Bangalore Vs Mumbai Indians Match Scorecard The Ultimate Showdown

USAA has been investing heavily in technology to improve member experiences. From chatbots to digital platforms, they’re modernizing every aspect of their operations. And as much as we love convenience, it’s undeniable that some jobs will become obsolete in the process.

Cost Reduction

Let’s face it—every company needs to keep an eye on the bottom line. In 2025, the economic climate is unpredictable, and USAA isn’t immune to market fluctuations. By reducing staff, they can lower operational costs and ensure long-term sustainability. It’s a tough pill to swallow, but it’s a reality many businesses are facing.

What’s the Impact on Employees and Customers?

For Employees

Okay, let’s talk about the elephant in the room. If you’re an employee at USAA, the news of layoffs can be scary. Losing your job isn’t just about finances—it’s about stability, identity, and peace of mind. That said, USAA has a history of treating its employees well. They’ve offered severance packages, outplacement services, and other resources to help those affected by layoffs.

But beyond the immediate impact, there’s also the emotional toll. Employees might feel uncertain about their future or question the company’s commitment to its workforce. Transparency and communication will be crucial in navigating these challenges.

For Customers

Now, let’s shift gears and talk about the customers. If you’re a USAA member, you might be wondering how these layoffs will affect your experience. Here’s the good news: USAA is committed to maintaining top-notch service. While some roles may disappear, the company is doubling down on technology to ensure seamless interactions.

In fact, many customers might not even notice a difference. Digital tools like mobile apps and online portals are designed to make life easier for members. So while the human touch might diminish slightly, the overall quality of service should remain strong.

How Can You Prepare for These Changes?

For Employees

If you’re an employee worried about layoffs, there are steps you can take to prepare. Start by updating your resume, networking with industry professionals, and brushing up on your skills. Consider enrolling in courses or certifications that align with your career goals. Remember, change can be an opportunity—if you approach it with the right mindset.

Also, don’t hesitate to reach out to USAA’s HR team for guidance. They might offer resources or programs to help you transition smoothly. And hey, who knows? This could be the push you need to explore new opportunities and grow your career.

For Customers

As a customer, the best thing you can do is stay informed. Keep an eye on USAA’s announcements and updates, and don’t hesitate to reach out if you have questions. If you’re concerned about service quality, try using their digital tools to see how they stack up. Most importantly, trust that USAA is committed to serving its members—even during challenging times.

Is This Part of a Broader Industry Shift?

The Financial Sector in 2025

Absolutely. What’s happening at USAA is reflective of broader trends in the financial sector. Banks and insurance companies everywhere are grappling with the same issues—automation, cost reduction, and adapting to changing consumer preferences. It’s a tough balancing act, but one that’s necessary for survival in today’s economy.

That said, not all companies are handling it the same way. Some are investing heavily in tech, while others are focusing on mergers and acquisitions. USAA’s approach might differ from its competitors, but the underlying drivers are the same. As a member or employee, it’s important to understand this context so you can make informed decisions.

Key Data and Stats About USAA

The Numbers Don’t Lie

Here are some key stats to give you a clearer picture of USAA’s current state:

- Founded in 1922, USAA serves over 13 million members.

- They offer a wide range of services, including banking, insurance, and investments.

- In recent years, USAA has invested millions in technology and innovation.

- Their member satisfaction ratings consistently rank among the highest in the industry.

These numbers highlight USAA’s strength and resilience, even amidst challenging times. While layoffs are never easy, they’re part of a larger strategy to ensure long-term success.

What Should Customers Know?

Transparency and Trust

At the end of the day, trust is everything. USAA has built its reputation on serving its members with integrity and care. Even as they navigate layoffs and other challenges, their commitment to customers remains unwavering.

If you’re a customer, here’s what you should know:

- USAA is investing in technology to enhance your experience.

- They’re prioritizing transparency and communication throughout this process.

- Your satisfaction remains their top priority, no matter what changes occur.

So rest assured—you’re in good hands with USAA. They’ve got a solid track record, and there’s no reason to believe that will change anytime soon.

The Future of USAA

Looking Ahead

While the rumors of layoffs in 2025 might seem daunting, they’re just one chapter in USAA’s story. The company has a long history of adapting to change and emerging stronger. By embracing technology, streamlining operations, and staying true to its mission, USAA is well-positioned for the future.

Here’s what you can expect moving forward:

- Continued investment in digital innovation.

- Expanded offerings to meet evolving member needs.

- A focus on sustainability and long-term growth.

Change is inevitable, but so is progress. USAA’s ability to evolve while staying true to its core values will be key to its success in the years to come.

Final Thoughts: Stay Calm and Informed

Alright, let’s wrap this up. USAA layoffs in 2025 are certainly a big deal, but they’re not the end of the world. Whether you’re an employee, a customer, or just someone following the news, it’s important to stay calm and informed. Understanding the reasons behind these changes—and how they’ll impact you—can help you navigate this uncertain time with confidence.

For employees, preparation is key. Update your skills, network with peers, and take advantage of any resources USAA offers. For customers, trust that USAA remains committed to delivering exceptional service. And for everyone else, remember that change is a natural part of growth.

So here’s what I want you to do next: Share this article with someone who might find it helpful. Leave a comment below with your thoughts or questions. And most importantly, stay positive and proactive as we move into this new chapter. You’ve got this!

Article Recommendations